On the Cover

Pandemic Rebound? First Start with a Clean Slate

St. George's freshened up its brand before reconnecting with shoppers whose habits COVID altered.

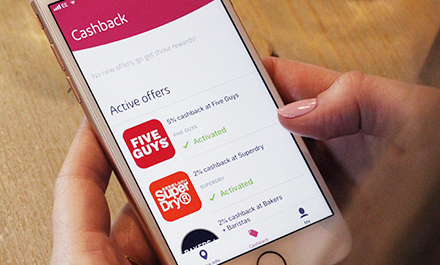

As the largest shopping center landlord in the UK, intu owns more than a dozen retail destinations across the country (and three in Spain) and welcomes more than 400 million visitors annually. Looking to drive footfall, strengthen ties with participating retailers, and blend the digital experience and physical shopping habits of its customers, it launched an in-store cashback app that rewards shoppers for spending among the resident tenants’ rows and racks.

The app offers shoppers 2%-10% cashback on any item purchased offline from participating retailers and restaurants across intu’s 14 UK retail destinations. As an extra, it also provides a number of bonus offers (up to 90% discount) to influence shopping behavior in a particular location on a specific day. With continued daily growth, the team has close to 40 brands and 200+ stores signed up.

Using innovative card-linking technology to track the transactions made by the same cards in-store, customers can add their traditional payment cards to intu Pocket and use their cashback in-store or transfer it to their bank account once the equivalent of US$6.50 has been earned. The intu team also notes that anonymized data that it collects through the app will give retailers access to real-time customer insights. Before the launch of the app, while intu benefited from a large user database, the team sought an effective way of engaging with users.

“Online shopping data is used to build loyalty and drive sales, and we wanted to provide some of the same benefits to intu’s customers and retailers. intu Pocket enables us to reward shoppers for spending their money at an intu center and helps to increase [traffic] and sales at our retailers’ stores,” explained Trevor Pereira, intu’s digital and commercial director.

Discussing the scale of the owner, Pereira believes intu is positioned to elevate the consumer experience and ensure the continued success of its retailers. Following the developing of a proposition deck, it generated awareness of the initiative by reaching out at a center-to-center level and promoting the app via e-mail and social media to each property’s database. Next, the team implemented SMS promotions to visitors in-center, such as via Wi-Fi and social media channels. The company established a dedicated unit that is responsible for working with key brands and introducing them to the platform.

Posted on intu’s website is an interview featuring Pereira. During the back and forth, the representative describes intu Pocket as a loyalty program and explains why card-linking works better than open banking alternatives. He shares that the purpose of the app is to reach people in a way that’s relevant to them wherever they are and expand their shopping experience beyond a single transaction with a brand.

As a result of personal experience in the space and extensive research, the team decided that card-linking was the only way to re-create an online reward system in the physical world. With changes in open banking regulation a major consideration, intu partnered with Fidel’s card-linking API to establish a quick, easy, and successful implementation process.

“Card-linking enables us to consolidate a lot of in-center rewards and is the simplest possible way for [intu] to reward visitors. It’s the most direct route for us to speak to our rent-paying customers and get their offers into visitors’ hands…The granularity of the data and the flexibility of the program means [participating retailers and F&B operators] can set up different offers for specific times of the day or week, or even for individual stores across their portfolio or spending thresholds,” Pereira added.

“Our next step is to work more closely with brands to see how tactical use of rewards can influence behavior while visitors are physically in-store. At this time, we’re largely using static offers as an incentive to get more footfall to our centers, but when we have more scale, we’d like to see how we can move customers around using the app.”

Key Takeaways

The goal of the initiative: Signing up as well as tracking brands and visitors, and analyzing spend metrics.

The primary benefit of card-linking: Getting a better idea of the value of the company’s database (i.e., gathering of transaction and spend data).

The result: In the first three months since the app’s launch (March to June 2019), the average intu card-linked amount increased by 47%. The conversion rate of those who downloaded the app and became members to having them actually link their card and spend in-center exceeded intu’s initial targets.